Transfer Pricing is fast becoming one of the most critical issues faced by international businesses operating in the region. It is imperative that multinationals understand the principles of transfer pricing, their practical application, and their impact on operations in the region and worldwide.

To help you navigate the evolving tax landscape we have developed the Diploma in Transfer Pricing, in exclusive partnership with Tolley, the leading provider worldwide of practical tax training. This one-of-its kind Diploma is accredited by the Association of Taxation Technicians (ATT) and is recognised globally.

With the support of our tax training experts, who are industry practitioners with regional experience, you will learn Transfer Pricing fundamentals, their application, assessments, issues and compliance.You will develop an in-depth knowledge of the OECD Transfer Pricing Guidelines with the help of specific jurisdictional illustrations As the regional regulations are heavily influenced by the OECD guidelines, this will lay a strong foundation for you to interpret the regional laws.

Who is it for?

This is the right choice for you if you are in executive management within a multinational enterprise, including finance, tax, legal or procurement personnel. It is also suitable if you are an economist, tax and transfer pricing in-house manager, advisor, or if you are simply interested in understanding Transfer Pricing guidelines and their application.

How do I earn the Transfer Pricing Diploma?

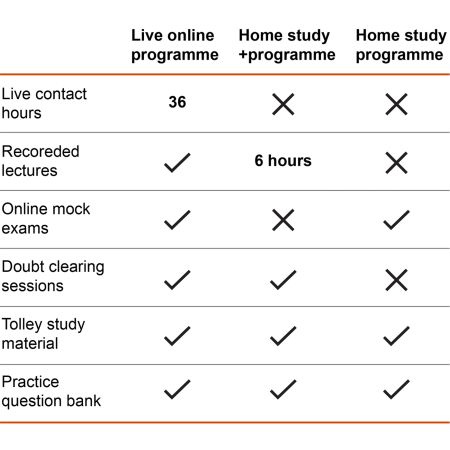

The programme is designed to suit learning preferences of professionals. You complete four practical modules in-class through learning and testing, and earn the diploma by attempting a final exam. You can also choose a self-study programme to suit your pace of learning.

When you have completed the final diploma exam, you will be awarded the Transfer Pricing Diploma from the Association of Taxation Technicians.

Note: The designatory letters "ATT" cannot be put after your name when you complete the Transfer Pricing Diploma.

Course structure

More about the Qualification

The Association of Taxation Technicians (ATT) is the leading professional body for providing UK tax compliance services. Their primary charitable objective is to promote education and the study of tax administration and practice. One of the key aims of ATT is to provide an appropriate qualification for individuals who undertake tax compliance work. ATT has over 8,300 Members and Fellows, and over 5,000 students. Members use the practising title ‘Taxation Technician’ or ‘Taxation Technician (Fellow)’ respectively. To know more about ATT, please click here: https://www.att.org.uk/

Meet our trainers

Schedule

- Diploma in Transfer Pricing Home Study PlusDiploma in Transfer Pricing Home Study Plus

Home Study

Home Study 4591

AED

4591 AED

4591

AED

4591 AED - Diploma in Transfer Pricing Home StudyDiploma in Transfer Pricing Home Study

Home Study

Home Study 3658

AED

3658 AED

3658

AED

3658 AED - Diploma in Transfer Pricing - G13 - Live Online and Face to FaceDiploma in Transfer Pricing - G13 - Live Online and Face to Face

6

6 7190

AED

7190 AED

7190

AED

7190 AED

It was a great experience for me to attend the course of Transfer Pricing Diploma with PWC, the course contents and objectives were arranged in an understandable manner making it much easier to review for the exam.

Ahmed HarfoushThe course was comprehensive and covered topics relevant to my role as transfer price officer. The lecturer was very helpful and open to questions. The best thing about the course was the focus on practical aspects rather than just pure academics…

Zeeshan JawaidThe Diploma in Transfer Pricing was very informative and one of the best learning experiences I have had at PwC’s Academy. It is a well-designed course with practical orientation. I was able to employ the skills I’ve learned, with great results…

Dolly Abou Younes

Connect with our team

Ahmad Salem

Training ConsultantKSAShruti Joshi

Manager - Client RelationsUAEMonisola Yahaya

We are a community of solvers combining human ingenuity, experience and technology innovation to deliver sustained outcomes and build trust.

It all adds up to The New Equation.